1/ Gauntlet vaults functioned as expected in response to the events of the past week. Our vaults had no exposure to xUSD, and our curation methodology ensured we were prepared for this type of market volatility.

We are grateful to capital suppliers who voted with their capital and continue to trust Gauntlet vaults.

2/ We measure the success of our 75+ vaults with $2B+ TVL by how they respond to these kinds of stress events. Here's how our vaults responded:

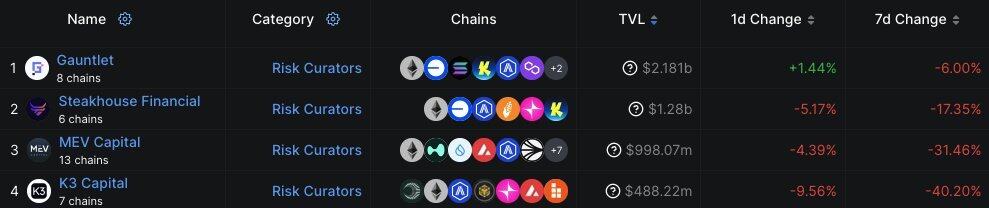

• Overall curator TVL fell ~21% between 10/30 and 11/5, whereas Gauntlet TVL dipped ~11% over the same timeframe

• No losses experienced in Gauntlet-curated vaults

• No exposure to xUSD, as it did not meet our due diligence requirements

• No exposure to the Balancer exploit

3/ How we approach vault curation on protocols like @MorphoLabs

Gauntlet vaults are specifically designed to handle this type of crypto market volatility. Our risk management and curation framework balances yield generation and risk mitigation for events like these.

• Collateral due diligence: we only add markets to our vaults where the collateral asset has passed our robust due diligence process. xUSD did not.

• Active monitoring: our curation systems, informed by years of managing risk for the largest DeFi protocols, continuously monitor prices, liquidity, and market health, ensuring that we respond quickly to market changes.

• Risk-off automation: we implement risk-off actions through automated rebalancing and preemptive reallocations when simulated price and liquidity shocks indicate potential insolvent debt.

4/ Systems built on 7+ years of risk management experience

We’ve managed risk in DeFi since 2018, implementing risk parameter updates, assessing collateral selection, and developing governance frameworks for the largest protocols in DeFi. Our risk models have evolved over the years to ingest vast datasets that inform our vault allocations.

The models we employ are battle-tested across cycles.

6/ Explore more data about risk curators:

2.12萬

121

本頁面內容由第三方提供。除非另有說明,OKX 不是所引用文章的作者,也不對此類材料主張任何版權。該內容僅供參考,並不代表 OKX 觀點,不作為任何形式的認可,也不應被視為投資建議或購買或出售數字資產的招攬。在使用生成式人工智能提供摘要或其他信息的情況下,此類人工智能生成的內容可能不準確或不一致。請閱讀鏈接文章,瞭解更多詳情和信息。OKX 不對第三方網站上的內容負責。包含穩定幣、NFTs 等在內的數字資產涉及較高程度的風險,其價值可能會產生較大波動。請根據自身財務狀況,仔細考慮交易或持有數字資產是否適合您。